Understanding your borrowing power is crucial for making informed financial decisions. This guide explores the factors influencing how much you can borrow, from your income and credit history to external economic conditions. We’ll delve into various loan types and alternative financing options, equipping you with the knowledge to navigate the loan application process confidently.

Income assessment methods, debt-to-income ratios, and the impact of credit history are key components of determining your borrowing capacity. We’ll analyze how these factors interplay and provide actionable insights for borrowers seeking to maximize their borrowing potential.

Introduction to Borrowing Power

Borrowing power, in the context of personal finance, refers to the maximum amount of debt a person can realistically take on, based primarily on their income. It’s essentially the upper limit of loans or credit facilities a lender is willing to approve, considering the individual’s ability to repay. This capacity is directly tied to their earnings and other factors influencing their financial stability.

Understanding your borrowing power is crucial for responsible financial planning. Knowing this limit helps avoid overextending oneself financially, leading to potential debt problems. It also enables informed decision-making when applying for loans, ensuring the chosen loan amount aligns with your capacity to repay. A proper understanding of this concept allows individuals to make sound financial choices, ultimately contributing to long-term financial well-being.

Factors Influencing Borrowing Power

Several key factors play a role in determining an individual’s borrowing power. These factors encompass both financial and non-financial aspects. Lenders consider these factors to assess the risk associated with lending money.

- Income Stability and Consistency: A steady and predictable income stream is a strong indicator of repayment ability. Lenders prefer applicants with a history of consistent employment and earnings. For instance, a salaried employee with a long employment history and predictable raises is typically viewed more favorably than a self-employed individual with fluctuating income.

- Debt-to-Income Ratio (DTI): This ratio measures the proportion of an individual’s income that is allocated to existing debts. A lower DTI usually translates to a higher borrowing power. For example, someone with a low DTI, meaning a smaller portion of their income is already dedicated to debt, can typically secure larger loans compared to someone with a high DTI.

- Credit History: A strong credit history, demonstrating responsible repayment habits, significantly impacts borrowing power. A history of on-time payments, low credit utilization, and avoidance of defaults shows lenders a borrower’s reliability. For instance, a borrower with a credit score above 700 often receives more favorable loan terms and a higher borrowing limit compared to one with a lower score.

- Assets: While not always a direct factor, assets like savings and investments can influence borrowing power. These assets demonstrate financial stability and can act as collateral, increasing the likelihood of loan approval and potentially higher borrowing limits.

Importance of Understanding Borrowing Power

Knowing your borrowing power enables strategic financial planning. It allows you to make informed decisions regarding the amount of debt you can comfortably manage.

| Component | Description |

|---|---|

| Income | Your regular earnings, including salary, wages, and other sources. |

| Debt | Existing loans, credit card balances, and other financial obligations. |

| Credit History | Past record of borrowing and repayment behavior, impacting your creditworthiness. |

| Assets | Savings, investments, and other possessions that can serve as collateral or demonstrate financial stability. |

| Credit Score | A numerical representation of your creditworthiness, influencing lenders’ decisions. |

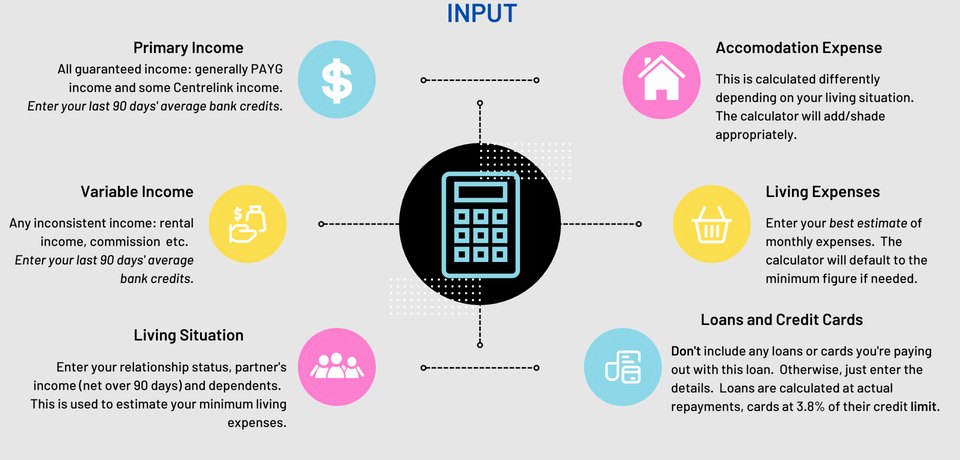

Income Assessment Methods

Determining your borrowing power hinges significantly on how lenders assess your income. Understanding these methods allows you to effectively present your financial situation and potentially secure favorable loan terms. Accurate income reporting is crucial for both the lender and the borrower to ensure a mutually beneficial agreement.

Lenders employ various strategies to evaluate income, ensuring a responsible approach to lending. These methods take into account the different forms and stability of income to make informed decisions about loan applications. This careful evaluation is vital for both the lender and the borrower, ensuring a fair and responsible lending process.

Gross Income vs. Net Income

Gross income represents the total earnings before any deductions, while net income is the amount remaining after taxes and other deductions are subtracted. Lenders typically consider both gross and net income to get a comprehensive picture of an applicant’s financial situation. Gross income provides a measure of total earning potential, while net income reflects the actual disposable income available for repayment.

Gross income is typically considered a broader indicator of earning capacity, whereas net income reflects the actual amount of money available to meet financial obligations.

The difference between these two income measures is crucial. For example, an applicant with a high gross income but substantial deductions might have a lower net income, which could affect their borrowing power. Lenders carefully analyze both to assess the applicant’s ability to repay the loan.

Variable Income Considerations

Variable income, such as commissions or freelance earnings, presents a unique challenge for lenders. The fluctuations in income can make it harder to predict the applicant’s consistent repayment capacity. Lenders often require proof of consistent income over a period to mitigate this risk. For example, several months of bank statements or tax returns showing a relatively stable income stream might be required. Lenders often request detailed income documentation over a specific period, such as the past two years, to assess the applicant’s consistent earnings history.

Types of Income Considered by Lenders

Lenders consider a variety of income sources when assessing borrowing capacity. These sources encompass more than just salary or wages. The key is to demonstrate a consistent and verifiable income stream.

- Salary/Wage Income: This is the most common form of income, typically derived from employment. Lenders review pay stubs and employment verification to assess consistency.

- Self-Employment Income: Lenders need evidence of consistent earnings, such as tax returns, profit and loss statements, and bank statements showing consistent income.

- Rental Income: Proof of consistent rental income, such as lease agreements and rental statements, is vital. Lenders assess the reliability of this income stream.

- Investment Income: Interest from savings accounts, dividends from stocks, and other investments are considered. Consistent records of investment income are necessary.

- Government Benefits: Social Security, unemployment, and other government benefits are also taken into account. Lenders examine official documentation and proof of continued eligibility.

Income Type Comparison

The following table summarizes the relevance of various income types to borrowing power:

| Income Type | Relevance to Borrowing |

|---|---|

| Salary/Wage | High relevance; consistent and verifiable |

| Self-Employment | Moderate relevance; requires detailed financial documentation |

| Rental Income | Moderate relevance; depends on the consistency and stability of the rental income |

| Investment Income | Low relevance unless a significant portion of overall income; requires documentation |

| Government Benefits | Moderate relevance; requires proof of eligibility and consistency |

Debt-to-Income Ratio (DTI)

Understanding your debt-to-income ratio (DTI) is crucial when assessing your borrowing power. A lower DTI generally indicates a greater capacity to handle additional debt, increasing your chances of loan approval. This ratio essentially measures the proportion of your income that goes towards servicing existing debts.

Understanding the DTI Concept

The DTI ratio is a key metric lenders use to evaluate your financial responsibility. It signifies how much of your income is allocated to paying off existing debts. A lower DTI often translates to a higher borrowing capacity, while a higher DTI suggests a greater financial burden, potentially impacting your ability to take on new debt.

Examples of DTI Ratios and Implications

Different DTI ratios reflect varying levels of financial responsibility. A DTI of 30% typically indicates a good financial standing, while a DTI exceeding 43% might raise red flags for lenders, making loan approvals less likely. An example of a low DTI is someone who has a significant portion of their income left after paying off existing debts, thus demonstrating financial stability and a higher likelihood of managing additional borrowing. Conversely, someone with a high DTI might struggle to meet new loan obligations, potentially leading to difficulties in managing repayments.

Calculating DTI

To calculate your DTI, divide your total monthly debt payments by your gross monthly income. For instance, if your monthly debt payments are $2,000 and your gross monthly income is $5,000, your DTI is 40%.

DTI = (Total Monthly Debt Payments) / (Gross Monthly Income)

Sample Calculation and Scenario

Imagine a person with a gross monthly income of $4,000. Their monthly debt obligations consist of $800 for a mortgage, $300 for car payments, and $200 for credit card debt. Calculating their DTI:

DTI = ($800 + $300 + $200) / $4,000 = 1300 / 4000 = 0.325 or 32.5%

Their DTI is 32.5%, which is considered a healthy ratio.

DTI Ratios and Borrowing Limits

The following table demonstrates the relationship between DTI ratios and potential borrowing limits, illustrating the influence of financial responsibility on loan approvals.

| DTI Ratio | Potential Borrowing Limit (Example) |

|---|---|

| 20% | High |

| 30% | Moderate |

| 40% | Low |

| 50% | Very Low |

Note: The borrowing limits in the table are illustrative examples and may vary based on specific loan programs and lender policies.

Credit History and its Impact

Your credit history is a crucial factor lenders consider when evaluating your borrowing power. It provides a detailed record of your past borrowing behavior, revealing your repayment responsibility and creditworthiness. A positive credit history demonstrates your ability to manage debt effectively, which is a key indicator for lenders. Conversely, a negative credit history may lead to higher interest rates or loan denials.

Credit history essentially serves as a report card for your financial responsibility. Lenders use this information to assess your risk profile and determine how much you can borrow safely. The more positive your credit history, the more favorable the loan terms you can expect.

Credit Scores and Loan Approvals

Credit scores, numerical representations of creditworthiness, significantly influence loan approvals and interest rates. Higher scores generally translate to better loan terms, including lower interest rates and larger loan amounts. Conversely, lower scores often result in higher interest rates, stricter loan terms, or outright loan rejections. Lenders utilize credit scores as a standardized measure of credit risk, facilitating a more objective assessment process.

Impact of Negative Credit Events

Negative credit events, such as late payments, defaults, or collections, can significantly damage your credit score and future borrowing opportunities. For instance, missing payments on credit cards or loans can lead to negative marks on your credit report, impacting your credit score and making it harder to secure loans or credit lines in the future. These negative marks can remain on your credit report for several years, affecting your ability to borrow at favorable terms. Collections, indicating unpaid debts that have been transferred to a debt collection agency, can be particularly detrimental to your creditworthiness. Each negative event can lower your credit score, making future borrowing more difficult and expensive.

Credit History and Loan Terms

Credit history directly influences the loan terms you qualify for. Borrowers with excellent credit histories often receive favorable loan terms, such as lower interest rates, longer repayment periods, and higher loan amounts. For example, a borrower with a high credit score might be offered a mortgage with a lower interest rate than someone with a lower score. Conversely, those with less-than-ideal credit histories might encounter higher interest rates, shorter repayment periods, and smaller loan amounts. These differences in terms reflect the lender’s assessment of risk associated with the borrower.

Illustrative Credit Score and Borrowing Power

| Credit Score Range | Typical Borrowing Power |

|---|---|

| 700-850 | High borrowing power, potentially for larger loans at favorable interest rates. May qualify for multiple loans simultaneously. |

| 650-699 | Moderate borrowing power, likely eligible for loans, but potentially with slightly higher interest rates. |

| 600-649 | Lower borrowing power, may face higher interest rates or limited loan options. |

| Below 600 | Very low borrowing power, significantly limited loan options, or loans may not be available at all. May be required to put a larger down payment or find a co-signer. |

Types of Loans and Borrowing Limits

Understanding the different types of loans and their associated borrowing limits is crucial for responsible financial planning. Knowing your options and how your income and debt levels affect those limits empowers you to make informed decisions about borrowing.

Common Loan Types

Different loan types cater to various financial needs. This section Artikels some common types, highlighting their distinct characteristics.

- Mortgages: These loans are used to purchase a home. Lenders typically consider factors such as the appraised value of the property, the borrower’s credit score, and the loan-to-value ratio (LTV) in determining the maximum loan amount.

- Auto Loans: Auto loans are taken out to finance the purchase of a vehicle. The lender assesses factors like the vehicle’s price, the borrower’s credit history, and the loan term to determine the loan amount.

- Personal Loans: These are unsecured loans used for various purposes, such as consolidating debt or funding home improvements. The loan amount often depends on the borrower’s creditworthiness and income.

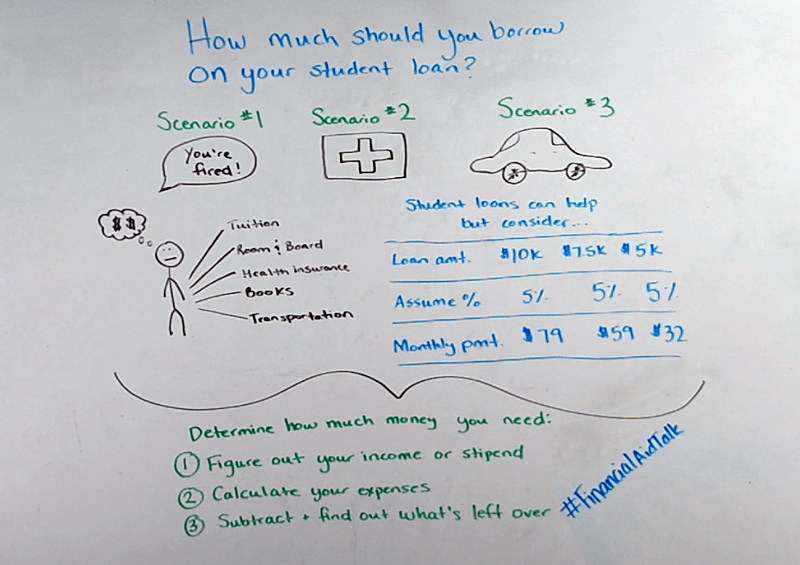

- Student Loans: These loans are designed to fund higher education. The maximum loan amount is usually tied to the cost of attendance and the borrower’s eligibility, with income serving as a crucial factor.

- Home Equity Loans: These loans allow homeowners to borrow against the equity they’ve built in their home. The loan amount is often based on the appraised value of the property and the outstanding mortgage balance.

Secured vs. Unsecured Loans

The security backing a loan significantly impacts the borrowing limit.

- Secured Loans: These loans are backed by an asset, such as a house or car. This collateral reduces the risk for the lender, enabling them to offer potentially larger loan amounts and more favorable terms. The value of the collateral acts as a guarantee, and the lender may seize the asset if the borrower defaults. Examples include mortgages and auto loans.

- Unsecured Loans: These loans are not backed by collateral. Lenders rely solely on the borrower’s creditworthiness and income to assess risk. Consequently, unsecured loans typically have lower borrowing limits compared to secured loans, as the lender carries more risk. Examples include personal loans and some credit cards.

Borrowing Limits Based on Income and DTI Ratio

A crucial factor influencing borrowing limits is the borrower’s income and debt-to-income (DTI) ratio. Lenders use these metrics to evaluate the borrower’s ability to repay the loan.

- Higher income generally translates to higher borrowing limits. Lenders often consider a multiple of the borrower’s gross monthly income when calculating potential loan amounts. For example, a borrower with a high income might qualify for a larger mortgage loan.

- A lower DTI ratio suggests a greater capacity to manage debt, increasing the chances of securing a loan with a higher amount. Lenders often set maximum DTI ratios for various loan types.

Loan Type and Typical Borrowing Limits

This table summarizes typical borrowing limits for various loan types, keeping in mind that these are general estimations and actual limits can vary considerably based on individual circumstances.

| Loan Type | Typical Borrowing Limit Factors |

|---|---|

| Mortgage | Appraised value of property, loan-to-value ratio (LTV), borrower’s credit score, income, DTI ratio |

| Auto Loan | Vehicle price, borrower’s credit score, income, loan term |

| Personal Loan | Borrower’s credit score, income, DTI ratio, loan amount requested |

| Student Loan | Cost of attendance, borrower’s creditworthiness, income, eligibility requirements |

| Home Equity Loan | Appraised value of property, outstanding mortgage balance, borrower’s credit score, income, DTI ratio |

External Factors Affecting Borrowing Power

Beyond personal financial factors, external economic conditions significantly influence an individual’s borrowing capacity. Market fluctuations, economic trends, and regulatory changes all play a role in determining how much a borrower can obtain. Understanding these external influences is crucial for both borrowers and lenders to make informed decisions.

Employment Stability and Market Conditions

Employment stability is a cornerstone of borrowing power. Consistent employment demonstrates a reliable income stream, a key factor lenders consider. Conversely, individuals experiencing job insecurity or frequent career changes may face limitations on borrowing. Market conditions, such as economic downturns or periods of high unemployment, can also negatively impact borrowing power. During these times, lenders are generally more cautious, potentially restricting access to credit. A company’s performance in a market downturn, for example, might influence a business loan application. Similarly, individual job prospects in a struggling sector can also limit borrowing power.

Impact of Economic Downturns

Economic downturns often lead to reduced borrowing power. During recessions or periods of significant economic instability, lenders tighten credit standards to mitigate risk. This is because the potential for loan defaults increases as unemployment rises and consumer spending declines. For instance, the 2008 financial crisis saw a substantial contraction in lending activity across various sectors. Businesses and individuals alike struggled to secure loans, highlighting the direct link between economic health and borrowing power.

Effect of Interest Rate Changes

Interest rates directly impact borrowing power. Higher interest rates increase the overall cost of borrowing, reducing the amount individuals or businesses can afford to borrow. Conversely, lower interest rates make borrowing more affordable, potentially increasing borrowing power. For example, a 1% increase in interest rates on a mortgage could drastically reduce the maximum loan amount a borrower can qualify for. This relationship is a critical consideration for both borrowers and lenders.

Changes in Credit Availability

Credit availability is influenced by economic factors. During periods of economic strength, lenders are often more willing to extend credit. This increased credit availability can lead to higher borrowing limits for borrowers. Conversely, during economic downturns, lenders typically restrict credit access to reduce risk. This tightening of credit availability often translates to lower borrowing limits. Government policies also play a role in influencing credit availability. For example, regulatory changes might affect the lending practices of banks and other financial institutions.

Table of External Factors and their Influence

| External Factor | Influence on Borrowing Limits |

|---|---|

| Economic Downturns | Reduced borrowing limits due to increased risk aversion by lenders. |

| High Unemployment | Lower borrowing limits due to reduced income stability and increased risk of default. |

| Rising Interest Rates | Reduced borrowing limits as the cost of borrowing increases. |

| Strong Economic Growth | Potentially increased borrowing limits as lenders are more confident in the economy. |

| Changes in Credit Availability | May increase or decrease borrowing limits depending on the direction of credit availability. |

Loan Application Process and Requirements

The loan application process, while varying slightly between lenders, generally follows a structured path. Understanding the process and requirements beforehand can streamline the application and improve chances of approval. A thorough understanding of the documentation needed, the lender’s income assessment methodology, and potential delays or rejections will help applicants navigate the application effectively.

The process typically involves a series of steps, from initial inquiry to final disbursement. Applicants must provide complete and accurate information to lenders, adhering to the specific requirements Artikeld by the lender. Lenders meticulously evaluate the provided documentation to determine the applicant’s eligibility and the appropriate loan terms.

Documentation Required for Loan Applications

A comprehensive application often requires a collection of documents to verify the applicant’s identity, financial status, and creditworthiness. These documents serve as evidence to support the claims made by the applicant and assist the lender in making an informed decision.

- Government-issued photo identification: This includes a driver’s license or passport. This is essential to verify the applicant’s identity and legal standing.

- Proof of income: Pay stubs, tax returns, and bank statements are common examples. These documents help lenders assess the applicant’s ability to repay the loan.

- Proof of address: Utility bills, lease agreements, or recent mailings serve as evidence of the applicant’s residence.

- Credit reports: These reports provide insights into the applicant’s credit history, including payment patterns and outstanding debts.

- Other supporting documents: Depending on the loan type and lender, additional documentation might be requested, such as employment verification or asset statements.

Lender’s Income Assessment During Application

Lenders use various methods to evaluate an applicant’s income during the loan application process. The primary goal is to assess the applicant’s capacity to repay the loan. This typically involves verifying the consistency and stability of the applicant’s income.

- Review of pay stubs: Consistent pay stubs over a period of time indicate a steady income stream. Lenders examine these to determine if the income is sufficient to meet the loan obligations.

- Analysis of tax returns: Tax returns provide a broader picture of the applicant’s income and deductions. Lenders scrutinize this information to assess the reported income and any fluctuations.

- Examination of bank statements: Bank statements help lenders verify the applicant’s income, often by comparing the deposit patterns with the reported income.

- Debt-to-income ratio (DTI) calculation: The DTI ratio, calculated by dividing monthly debt payments by gross monthly income, is a key indicator of the applicant’s ability to manage debt obligations. A low DTI typically suggests a higher probability of repayment.

Potential Delays or Rejections During the Application Process

Delays or rejections during the loan application process can occur for several reasons. These reasons can range from incomplete or inaccurate information provided by the applicant to external factors influencing the lender’s decision. Applicants should be prepared to address any discrepancies promptly.

- Incomplete or inaccurate documentation: Missing or incorrect documents can cause delays or rejection. Applicants should double-check all submitted documents for accuracy.

- Adverse credit history: A poor credit history can significantly impact the loan approval process. Lenders prioritize applicants with a strong and consistent credit history.

- Unforeseen issues with verifying income: Difficulties in verifying income, such as inconsistencies in pay stubs or tax returns, can lead to delays or rejections.

- External factors: Economic downturns or market fluctuations can affect the lender’s lending practices and potentially delay or reject applications.

Loan Application Process Steps

| Step | Description |

|---|---|

| 1. Application Submission | Applicant completes and submits the loan application form along with required documentation. |

| 2. Initial Assessment | Lender reviews the application and supporting documents to determine preliminary eligibility. |

| 3. Credit Check | Lender conducts a credit check to assess the applicant’s creditworthiness. |

| 4. Income Verification | Lender verifies the applicant’s income through various methods, such as pay stubs, tax returns, and bank statements. |

| 5. Loan Approval/Rejection | Lender approves or rejects the loan application based on the assessment. |

| 6. Loan Disbursement | If approved, the loan funds are disbursed to the applicant according to the agreed-upon terms. |

Alternatives to Traditional Loans

Traditional loans often require a robust credit history and a substantial income to qualify. For borrowers with limited borrowing power, alternative financing options can provide access to capital. These alternatives cater to specific needs and circumstances, recognizing that creditworthiness isn’t the sole determinant of financial viability.

Alternative financing sources leverage various factors beyond credit history, such as collateral, income verification methods, and existing business relationships. These methods can be more flexible and accessible to individuals with less established credit profiles. This flexibility, however, often comes with different terms and conditions.

Alternative Financing Options

A range of alternative financing options exist for borrowers facing challenges with traditional lending. These options often offer tailored solutions based on the specific circumstances of the borrower. Understanding the strengths and weaknesses of each option is critical for informed decision-making.

Peer-to-Peer Lending

Peer-to-peer (P2P) lending platforms connect borrowers directly with individual investors. Borrowers typically present their loan requests, and investors assess the risk and potential return before committing funds. P2P lending can be a quicker process compared to traditional bank loans.

Pros of P2P Lending:

- Potentially faster loan processing times compared to traditional loans.

- Greater accessibility for borrowers with limited or less-than-perfect credit histories.

- Potential for lower interest rates than traditional loans in some cases.

Cons of P2P Lending:

- Interest rates can vary significantly depending on the borrower’s creditworthiness and the specific loan terms.

- Borrowers may need to provide extensive documentation to demonstrate their financial capacity.

- The risk of default is higher compared to traditional loans, and borrowers may face legal consequences if they fail to repay the loan.

Crowdfunding

Crowdfunding platforms allow entrepreneurs or individuals to raise capital by soliciting small investments from a large number of people. This method can be particularly useful for startups or projects with unique value propositions.

Pros of Crowdfunding:

- Potential for increased visibility and brand awareness for the project or business.

- Access to a broader pool of potential investors.

- Often more flexible terms compared to traditional loans, allowing for tailored agreements.

Cons of Crowdfunding:

- Success depends heavily on the project’s ability to attract enough investors.

- Often involves a longer timeframe for securing funding.

- Crowdfunding campaigns can be complex and require careful planning and execution.

Government-backed Loan Programs

Some governments offer specific loan programs to support particular industries or individuals. These programs often provide favorable terms, such as lower interest rates or longer repayment periods. These programs can be valuable for specific needs or sectors.

Pros of Government-backed Loan Programs:

- Lower interest rates and potentially more favorable repayment terms.

- Government support and guidance throughout the loan process.

- Targeted assistance for specific sectors or individuals.

Cons of Government-backed Loan Programs:

- Stricter eligibility requirements compared to other alternative financing options.

- Potential for longer loan application processing times.

- Availability of these programs can vary based on current economic conditions and government policies.

Alternative Loan Programs Summary

| Financing Option | How it Works | Pros | Cons |

|---|---|---|---|

| Peer-to-Peer Lending | Connects borrowers with individual investors. | Potentially faster, more accessible. | Variable interest rates, extensive documentation. |

| Crowdfunding | Raises capital by soliciting small investments from many people. | Increased visibility, broader investor pool. | Success depends on investor interest, longer timeframe. |

| Government-backed Loan Programs | Specific programs offering favorable terms. | Lower rates, government support. | Stricter requirements, longer processing. |

Building and Improving Borrowing Power

Boosting your borrowing power is a multifaceted process that requires proactive steps in managing your finances. A strong credit history and consistent financial habits are key components in securing favorable loan terms and achieving your financial goals. Improving your borrowing power isn’t a quick fix, but rather a journey built on responsible financial practices.

Credit Score Enhancement Strategies

A good credit score is often a prerequisite for favorable loan terms. Maintaining a positive credit history involves responsible use of credit. Paying bills on time and keeping credit utilization low are crucial factors. Avoiding unnecessary applications for new credit lines can also help prevent negative impacts on your score.

- Timely Payments: Consistently meeting your payment obligations demonstrates financial responsibility to creditors. This is a fundamental aspect of building a positive credit history. Late payments can significantly damage your credit score, making it harder to qualify for future loans.

- Low Credit Utilization: Keeping your credit card balances low in relation to your credit limit is important. A lower credit utilization ratio generally signifies better creditworthiness.

- Diverse Credit Mix: Having a variety of credit accounts, such as credit cards and loans, shows responsible management of different credit types. This demonstrates your ability to handle various financial commitments.

- Dispute Errors: Regularly review your credit reports for any errors. Inaccurate information can negatively impact your score. If you find errors, promptly dispute them to ensure your credit report reflects your accurate financial standing.

Debt Management Techniques

Effective debt management is crucial for improving borrowing power. High levels of debt can significantly impact your ability to secure loans. Strategies to manage debt effectively include developing a budget, prioritizing debt repayment, and exploring debt consolidation options.

- Budgeting: Creating a realistic budget allows you to track your income and expenses, identify areas where you can reduce spending, and allocate funds towards debt repayment.

- Prioritize High-Interest Debt: Focus on paying off debts with the highest interest rates first. This approach minimizes the overall interest paid over time.

- Debt Consolidation: Consider consolidating high-interest debts into a single loan with a lower interest rate. This can streamline payments and potentially save money on interest.

- Avoid Taking on New Debt Unnecessarily: Adding new debt when already burdened with existing debt can hinder your efforts to improve borrowing power. Thoroughly evaluate the need for additional borrowing before committing.

Income Enhancement Strategies

Increasing your income directly impacts your borrowing power. Higher income generally translates to a better ability to repay loans. Strategies for increasing income include exploring additional employment opportunities, seeking promotions, or pursuing higher education.

- Additional Income Streams: Consider part-time jobs, freelance work, or investments to generate additional income.

- Upskilling/Reskilling: Investing in education or training can enhance your skills and lead to higher-paying employment opportunities.

- Negotiating Salary Increases: Regularly assessing your skills and market value allows for informed salary negotiations with employers.

- Financial Investments: Smart investments can generate additional income over time.

Importance of Consistent Payments and Timely Debt Repayment

Consistent and timely payments are crucial for building a strong credit history. A history of reliable payments demonstrates financial responsibility and improves your borrowing power.

Consistent and timely payments are vital indicators of financial stability and reliability.

- Automating Payments: Automating your payments can ensure consistent and timely payments to creditors, which is vital for maintaining a positive credit history.

- Developing a Payment Schedule: Planning and sticking to a payment schedule for all debts is essential for avoiding missed payments and maintaining a positive financial track record.

Building a Strong Credit History Over Time

Building a strong credit history is a gradual process that requires consistent effort and responsible financial practices. The more positive credit history you build, the more options become available for borrowing in the future.

- Start Early: The earlier you begin building a strong credit history, the more time you have to establish a solid financial foundation.

- Patience and Persistence: Building a positive credit history requires consistent effort and patience over time. It is not an overnight process.

Building a Positive Financial Track Record

A positive financial track record is the foundation of improved borrowing power. This includes a combination of responsible spending, budgeting, and saving habits.

- Financial Literacy: Improving your financial literacy equips you with the knowledge to make informed financial decisions, leading to better financial habits.

- Long-Term Financial Planning: Planning for the long-term, including saving for the future, demonstrates financial foresight.

Practical Advice for Borrowers

Understanding your borrowing power is crucial for making informed financial decisions. It involves a thorough assessment of your current financial situation, careful research into available loan options, and a proactive approach to building your creditworthiness. This knowledge empowers you to secure the best possible loan terms and avoid potential financial pitfalls.

Assessing Your Borrowing Power

A key aspect of understanding your borrowing power is a comprehensive review of your financial situation. This involves scrutinizing your income, expenses, and existing debts. A clear picture of your cash flow, including both recurring and occasional expenses, is essential for determining how much you can comfortably afford to borrow. A budget, meticulously tracked, provides a concrete view of your financial standing and reveals areas for potential savings or adjustments. This self-assessment lays the groundwork for making well-informed borrowing decisions.

Understanding Your Personal Financial Situation

Thorough financial planning is vital for responsible borrowing. Regular review of your income and expenses, including savings and debts, is necessary to gauge your current financial health. Detailed budgeting, including fixed and variable expenses, provides a clear picture of your spending habits and potential adjustments. Consider using budgeting apps or spreadsheets to track your income and outgoings effectively. A clear understanding of your current financial situation empowers you to make responsible financial choices.

Researching and Comparing Loan Offers

Carefully comparing loan offers is crucial for securing the most favorable terms. Different lenders often have varying interest rates, fees, and repayment schedules. Use online resources, financial advisors, and bank websites to gather detailed information on various loan options. Consider factors such as interest rates, loan terms, and associated fees when evaluating different offers. A well-informed decision about loan offers minimizes risks and maximizes financial benefits.

Asking Questions and Seeking Professional Advice

Don’t hesitate to ask questions and seek professional advice when navigating the complex world of borrowing. Consult with a financial advisor or bank representative to clarify any uncertainties regarding loan terms, repayment options, or associated fees. They can provide valuable insights and guidance based on your specific circumstances. Professional guidance ensures informed decisions and reduces the likelihood of unforeseen issues.

Tips for Borrowers

- Create a detailed budget: Track all income and expenses meticulously to understand your cash flow accurately.

- Calculate your debt-to-income ratio (DTI): This ratio indicates the proportion of your income dedicated to debt payments, helping assess your borrowing capacity.

- Research various loan options: Compare interest rates, fees, and repayment terms from different lenders.

- Seek professional advice: Consult with a financial advisor or bank representative for personalized guidance.

- Understand the loan application process: Familiarize yourself with the required documentation and steps involved.

- Check your credit report regularly: Identify and address any inaccuracies or negative marks to improve your creditworthiness.

Q&A

How do lenders assess my income for a loan?

Lenders typically consider gross or net income, depending on the loan type. They also evaluate the consistency and stability of your income. Employment history and documentation of income sources are vital aspects in this process.

What is a good debt-to-income ratio (DTI) for borrowing?

A lower DTI ratio generally indicates better borrowing power. However, the optimal DTI varies based on the specific loan type and lender requirements. Lenders typically prefer a lower DTI, often aiming for ratios below 43% for mortgages and 50% for other loans.

What if my income is variable?

Lenders may consider average income over a period or require additional documentation to assess your borrowing power accurately when dealing with variable income.

Can I borrow more if I have a co-signer?

A co-signer can enhance your borrowing power, as lenders consider the co-signer’s creditworthiness and income when assessing your application. This can result in higher loan amounts or better loan terms.

Further details about Hotels Offering Cryptocurrency Payments in 2025 is accessible to provide you additional insights.